Without a thorough budget plan, it can be difficult to track and manage your finances along with unexpected variances/expenses. A survey by small business credit provider Headway Capital found that although 57% of small business owners anticipated growth this year, nearly 19% were concerned about how unexpected expenses would impact their business.

If you want to keep your business operating in the black, you’ll need to account for both fixed and unplanned costs, and then create — and stick to — a solid budget. To that end, below is a list of five smart tips for small business owners.

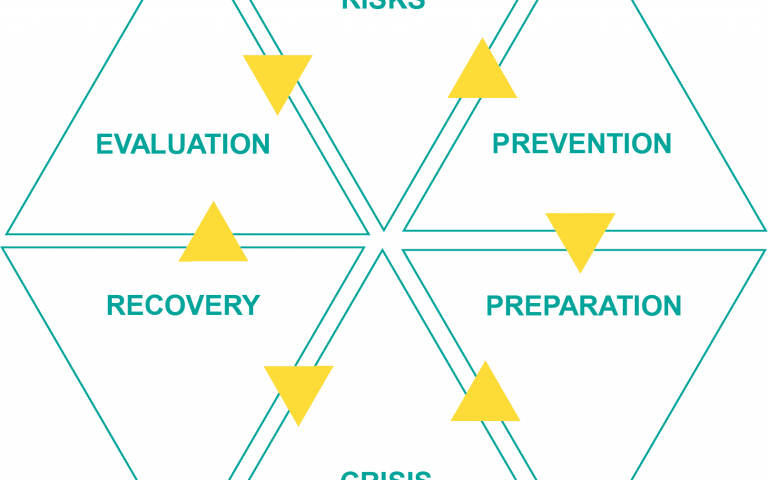

Define and understand your risks: Business owners need to consider their long- and short-term risks to accurately plan for their financial future. How will changes in minimum wage or health care requirements impact your workforce? Do you rely heavily on seasonal workers? Understanding your potential risks are monumentally important. Once you’ve mapped out the threats to productivity, a clearer picture can be built around emergency planning, insurance needs, and other expenditures and emergency funds necessary”

Be careful not to ever under-estimate your expenses: For example, if your business operates on a project-to-project basis, you know that every client is different and no two projects will turn out exactly the same. This means that often, you can’t predict when something is going to go over budget. For this reason, budgeting slightly above your anticipated line-item cost will help you from being caught between a rock and a hard place, and over time you will be able to best gauge how what percentage over your anticipated expenses you should add to your budget as a cushion.

Pay attention to your sales cycle: Many businesses go through busy and slow periods over the course of the year. If your company typically has a slow season, you’ll need to account for funding expenses during an earlier time. Furthermore, you may be able to use some of that downtime to engage in additional marketing effortsor perhaps creative methods to keep the cash flowing during that time. Both concepts require you to budget for accumulating funds to do so, ahead of time.

Plan for large purchases carefully and early: Some large business expenses occur when you least expect them — a piece of equipment breaks and needs to be replaced or your delivery van needs a costly repair, for instance. However, planned expenses like store renovations or a new software system should be carefully timed and budgeted to avoid a huge financial burden on your business.

Keep in mind that time is money: One of the biggest mistakes small businesses make is forgetting to incorporate their time into a budget plan, especially when working with or engaging people who are paid for their time.

There are also non-traditional expenses indirectly related to time. Estimating time for client feedback is an example. You need to budget your or your staff’s time for initiating a process of client feedback. The client will then need time to provide the necessary feedback so you can proceed. If the client is distracted with other issues, feedback planned for a three-day turnaround can become a week or longer. Not only do you start to lose time to the delivery schedule, your team also loses momentum as their collective thought shifts focus to another project.”

One last word of advice: Constantly revisit your budget. It should never be static or consistent. It will change and evolve along with your business and you’ll need to keep adjusting it based on your growth and profit patterns. Always pay attention to and revise your monthly and annual budgets regularly to get a clearer, updated picture of your business finances.

***

TITAN Business Development Group, LLC

www.TitanBDG.com