Building business credit plays a crucial role in your company’s funding ability. Except for Sole Proprietorships, which operate without any legal or financial distinction between the owner and his /her company, your business has the ability to establish its own credit file, separate from you as an individual. It should build it, protect it and capitalize on it, the same as any individual would their own credit record. Below are the five simple steps to building business credit.

Choose the right business structure and register your business. Your business needs to be a distinct entity, be it an LLC, LLP, or Corporation, for example. Sole proprietorships do not build their own credit histories because they are not recognized as separate legal entities form their owners.

Obtain your Federal Tax ID Number. This is the 9-digit number the IRS assigned to your business when you register the company. You will use it for tax filings, for banking, applying for business licenses and permits … and for applying for business credit.

Open a Business bank account. Once you have your federal tax ID, you will want to open a business bank account for your company. This is a mandatory step in creating a clear separation between your business and personal expenses.

Your banking relationships play an important role in your company’s funding potential. Not only does your business bank account serve as a bank reference on credit applications, but it also allows provides key data that lenders use during a funding review.

Establish credit with vendors/suppliers who report to the Credit Agencies. One of the easiest ways to build business credit is to apply for credit on Net Terms with Vendors and Suppliers. As you buy supplies, inventory, or other materials on credit, those purchases and payments are reported to the business reporting agencies and create your company’s Credit Profile. Eventually, a business credit rating (Credit Score) is generated. Remember, it is important to select vendors and suppliers that report to a business credit reporting agency. Additionally, they may serve as trade references on future credit applications as well.

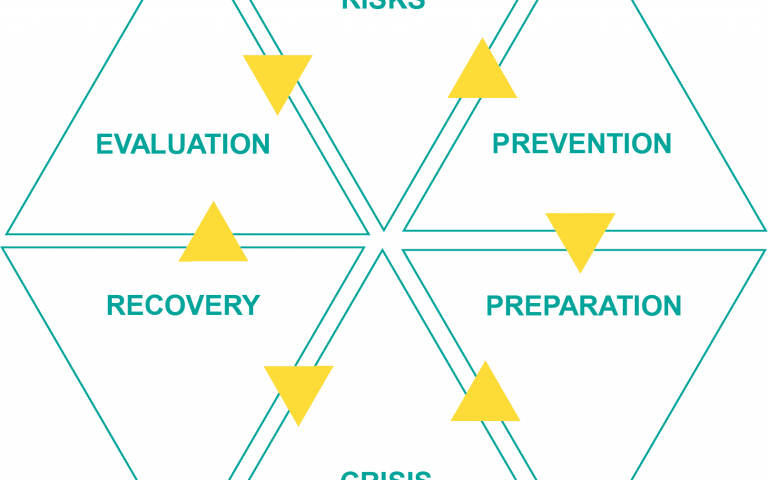

Monitor your business credit reports. Here are five key reasons to monitor your business credit to (1) ensure your company’s credit report is complete and accurate, (2) to be aware of on any changes to your report that could impact your business, (3) to identify any issues or areas in your report that can be improved upon, (4) and so that you are aware of who is inquiring about your business (inquiries).

With an established business credit report, you may get higher credit approvals, better interest rates and repayment terms on loans and lines of credit.

It is equally important to establish a diversity of accounts with other types of business credit such as business credit cards or lines of credit. Let these five simple steps serve as a starting point to building business credit for your company.