Try considering the value of your business from an investment standpoint. Eventually, you will ideally either pass the business on to a family member, sell it to key employees or sell it to a third party. Either way, your future is invested in the value of your business. By consciously developing the business as an investment you can expect a higher ROI when you eventually exit. You can improve the value of your business starting with cultivating these eight fundamentals:

Financial Performance: Want to woo a prospective buyer? Consider the business’s financial performance as one of the key pieces of information factoring into their decision. The more consistent financial performance has been in the past, the better it looks to a prospective buyer.

Growth Potential: Financial performance gives the buyer a glimpse into the past. Growth potential, on the other hand, will paint a picture of the company’s future. Since buyers are investing in the future of the company, its potential for growth is essential.

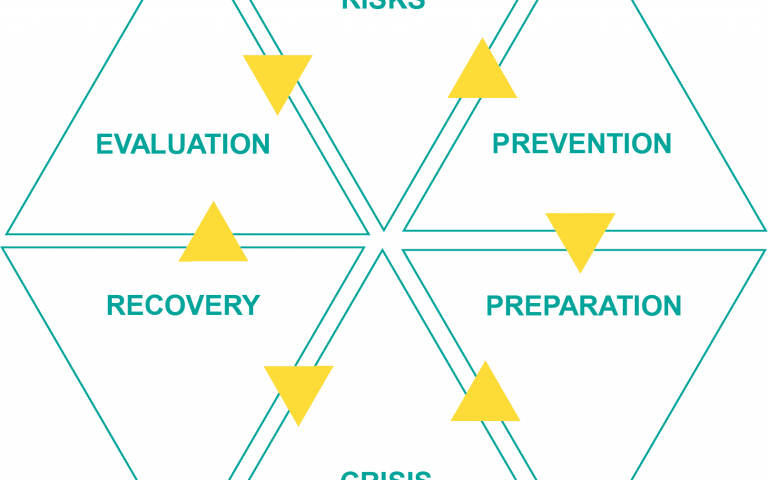

Risk mitigation: The business should not be dependent on any one customer, employee, or supplier- it is too risky and will be a big red flag to a buyer.

Equipment: Has it been more than a few years since the company’s equipment was updated? Then it may be time for an upgrade. If a buyer has to allocate more of their money to equipment costs, they are less likely to pay a higher asking price for the company as a whole.

Recurring revenue: If a business can provide the buyer with a dependable and consistent revenue stream, then it will look much more attractive to the buyer- particularly if that revenue stream is secured by a contract.

Market Control: Future cash flow is important, and the higher the barriers to entry, the harder it is for a competitor to take away market share. What differentiates your specific company?

Customer Satisfaction: High customer turnover likely means there is a problem with the business, and, if the company does nothing, it may impact the way the business is perceived in the marketplace. A buyer might hesitate to take over a company with a bad reputation.

Owner Independence: If the business is dependent on one person’s leadership, it’s going to be difficult to make the sale. In fact, the buyer may try to retain the owner’s presence in the company for a period to ensure a smooth transition – which could defeat the purpose of selling in the first place. Instead, start building a solid management team to ensure that your business will continue prospering long after you are gone.

In the least, you should begin really focusing in these areas at least 3 to 5 years before your intended exit. The truth is, though, that these are all good business drivers and as such deserve attention throughout the lifespan of your business. In this way, you are continually enhancing the value of your investment.

***