As you grow your business into a valuable asset, with an eye on the future, assess its current value using the eight key drivers of building business value discussed below. Each of these value drivers are used to evaluate where your business stands today and simultaneously outlines areas to improve for the future. They are also some of the key components a potential future buyer will look at from an attractiveness stance.

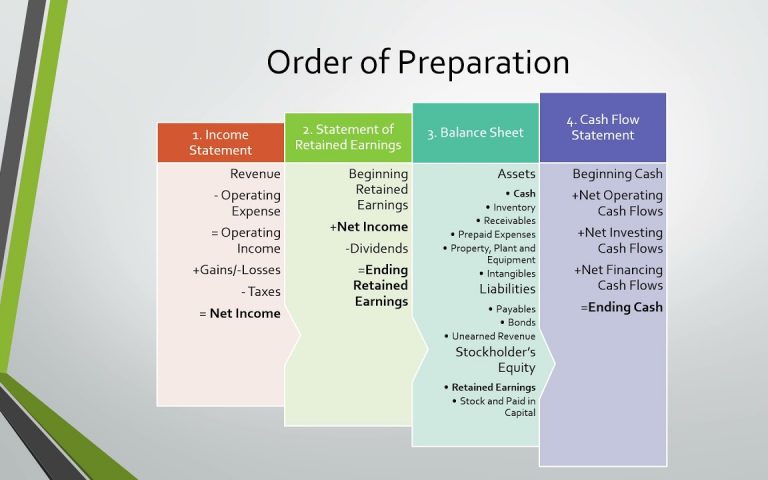

- Financial Performance

This value driver does not mean that you need to have an audited financial statement but it does mean you need to have concise financial information. The financial statements and metrics derived from them need to be accurate and reliable.

- Growth Potential

When addressing growth potential, it comes down to capacity. A company that is already at capacity is not going to be worth as much as a company that has capacity. When someone looks at buying your business, they want to buy it because they want to take the business to the next level. Key areas of growth potential are through revenue expansion and earnings predictability.

- The Switzerland Structure

Independence is the theme for this value driver. It is important to not be reliant exclusively on a single customer. A business should also not be reliant on a single vendor, a single supplier, or even single employees. Just like Switzerland, a company should be neutral to its customers, vendors, and employees, so there is no reliance on just one single source. Being too reliant on one customer, vendor, or employee can absolutely impact the business’s value.

- Working Capital

Working Capital is basically your company’s cash flow. It is the difference between receivables and inventory compared to accounts payable. One might think it is wise to pay all vendor invoices at once so there are no payables, but that’s not necessarily good from a cash flow standpoint. You do not necessarily want to have more receivables than payables on your financial statements because that might point to a situation where you are paying out more than you are bringing in. It is a very important balancing act.

- Repeat Sales (Recurring Revenue)

If you can find a way to have automatically recurring revenue instead of continually chasing after it, the more the value of your business will increase. To have a steady recurring revenue stream, determine what you can do with your business and what you can sell that can automatically repeat again and again.

- The Monopoly of Control

This value driver has to do with finding ways to differentiate yourself from other businesses. What can you do to really set yourself apart from your competition? The answer is to look at what your customers’ needs are. Every organization should challenge themselves to do this. If you do, you will have more ability to have pricing strength because you’re offering something that no one else offers. If you are just another goldfish in the goldfish bowl, your business will likely command a lower market value.

- Loyalty (Customer Satisfaction)

It is important to measure your customer loyalty and your customer satisfaction. Returning customers are valuable assets of the business. Another good measurement tool (use several) is the Net Promoter Score (NPS). The NPS is a survey designed to rate how likely customers are to refer someone to your business. Based on the scores, you can gauge levels of customer satisfaction.

- Management Depth (Hub & Spoke)

Do you have a management team in place or is the business solely reliant on you? This area is about changing the owner’s mindset from needing to be all in on the company details to one of being focused more on the high-level areas and being able to plan for the future. If the company is reliant on you to, say, bring in all the business or to operate, it will be hard for someone to take over when you’re the one who is doing most of the work. This would lower its value – what are the business-results when you’re not there? As the business owner, you need to plan and build your company’s ability to operate independent of you, thus raising its value.

In a perfect world, we would all eventually transition our businesses to someone (hopefully) and would want our businesses to firmly represent years of hard work, dedication, sacrifices, ingenuity, investment, and pride, by reflecting a commensurate value. Paying attention to these eight key drivers should help keep you on the path of some critical components important not only to healthy operations, but also ultimately to a prospective buyer.

***

TITAN Business Development Group, LLC

business coaching | advisory | exit planning