Knowing when to finance growth can sometimes be a challenge for many small business owners. For most businesses, growth is an option, not necessarily a survival factor. Some business owners take a very aggressive approach to growing their businesses; while others take a very conservative, slow growth, approach. Regardless of the approach you take with your business, how do you know when it’s time to grow and how do you know if borrowing capital to finance growth is a good idea?

Although there are successful companies that don’t aggressively pursue growth, many small business owners want to see their businesses grow quickly. With that in mind, here are some tell-tail signs it might be time to grow:

The market category you serve is growing as a whole: Not to be mistaken for one that is changing, necessarily. You need to continually innovate to serve the changing market. We are, however, talking about a market that has expanding opportunities. For example, if the new home construction market is on the rise and you are a mason, plumber, electrician or other related tradesman, perhaps you should expand by hiring more employees and going after those new opportunities that will create new demands.

You find a complementary product that can boost profits: Sometimes opportunities for growth come in the form of related products you can add to those you already offer. For example, Titan Business Development Group, which focuses on coaching and consulting, recently added virtual CFO services to its menu of service offerings.

Rising demand: Increasing capacity to accommodate your existing customers’ desire to buy more is a challenge most business owners want to face. There could also be an influx of new customers who want to purchase your products or services and you need to expand to meet the extra demand.

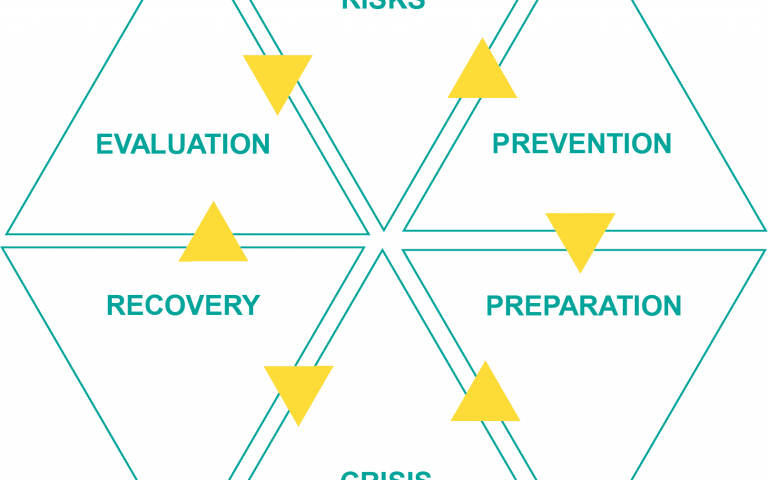

Market factors like those mentioned above are reasons many small business owners consider expanding, but how do you know if it’s worth the risk of financing that growth? If the following describes your business, financing growth with a loan might make sense:

You currently have a healthy business with a positive cash flow: lenders want to know you have the means to service new debt currently as well as moving forward. The cost of borrowing capital needs to be considered before you talk to a lender.

You have a plan: Borrowing money is a serious step that shouldn’t be taken with a “seat-of-the-pants” approach. Make sure you’ve given thought to how you will use the borrowed capital to help your business grow. Do you have a projected ROI for the investment of borrowed capital; do you know exactly how much you’ll need? The better you can answer these questions, the more likely the borrowed capital will do what you want it to and the more likely a lender will be willing to offer you a loan.

You have systems in place to handle the additional business: . If you have a plan and a process in place that will successfully accommodate growth, and all you lack is capital, you’ll be in a better place to leverage borrowed capital to fuel growth. If you don’t have a plan in place, talk with your business coach or other adviser.

The finances make sense: Popular culture would have you believe that all you need is capital to grow; however, before borrowing, it’s important to make sure the economics of the loan make sense. Does the cost of the loan make sense with the anticipated ROI of the growth project, can you make the periodic payments, do you have a contingency plan should things not go as expected?

Some companies fail because they didn’t grow enough. Some fail because they grew at the wrong time or even because the grew too fast. Recognizing growth opportunities is an important part of owning a small business and knowing when it makes sense to access borrowed capital to facilitate growth is a critical part of building a successful business.

***