Businesses are suffering right now because of the Coronavirus pandemic. As of this writing, restaurants have largely come to a screeching halt, retailers are reeling (unless they sell hand sanitizer and toilet paper!), travel has been curtailed and conferences and meetings are being cancelled. Key supply chains around the world have been disrupted and the markets have taken a dive. Fearful consumers – worried about their jobs and lifestyles – are holding on to their money.

As devastating as things have been and continue to be, sooner or later the virus will have run its course and things will get back to normal. The markets and the economy will eventually recover and though the landscape may look a little different, many of us who run businesses will be much smarter because of the 2020 coronavirus experience.

To begin with, some businesses hesitant to jump into the rapidly evolving world of technology with real gusto have finally begun to embrace some of the advantages it provides. For example, many businesses that were slow to embrace remote working as a productive and viable way of doing business have discovered that we are not all physically bound by work locations any longer.

Collaborative tools are helping keep employees and team members connected in productive ways. Data can change hands almost instantaneously and virtual meetings can even save travel time and geographic challenges. To be sure, much of the technology is mature by now and bosses are discovering that employees can be trusted. In fact, one could go far enough as to say many of the parties involved may have also discovered a better lifestyle as a result.

A number of businesses also learned a hard lesson about diversification. They learned that relying on a small pocket of suppliers (or clientele, for that matter) is not an optimal strategy. Certainly, it is not one that necessarily supports long-term growth. The raw materials or products that come from one or even two suppliers, be they foreign or domestic, may come at better terms, including price, but what happens when that one (or two) supplier you over-relied on shuts down for a period? A more careful plan would be to temper this over-reliance and instead have a strategy of spreading the business’ critical needs across multiple suppliers. This is exactly what happened to many companies that relied on goods and materials solely from China, particularly at the very beginning, especially before the outbreak spread world-wide.

Let’s also talk about cash. To be sure, cash is king – and this king is a fickle one. There are always down-swings and, often, critical periods in the cash-flow cycle. The smartest business owners who have navigated rough waters before – such as during the last big economic downturn (think 2008 recession) – will tell you all sorts of reasons why they survived. They’ll talk about how they cut costs, experimented with new products, partnered, diversified and downsized unnecessary staff. These are things we should continually be doing in our businesses. But they’ll also admit to one other major thing: They had cash.

When you have cash in the bank you make smarter decisions and better investments because you’re negotiating from a stronger financial position. More importantly, you’re also able to deal with other challenges like the economic uncertainties caused by both internal and external forces. Just watch and you’ll sadly see many small businesses shut their doors in the coming year due to the economic slowdown caused by the coronavirus. However, many of the ones that remain do so largely because they had cash in the bank, and that was intentional. It’s not just the coronavirus at play, here. It’s Darwinism.

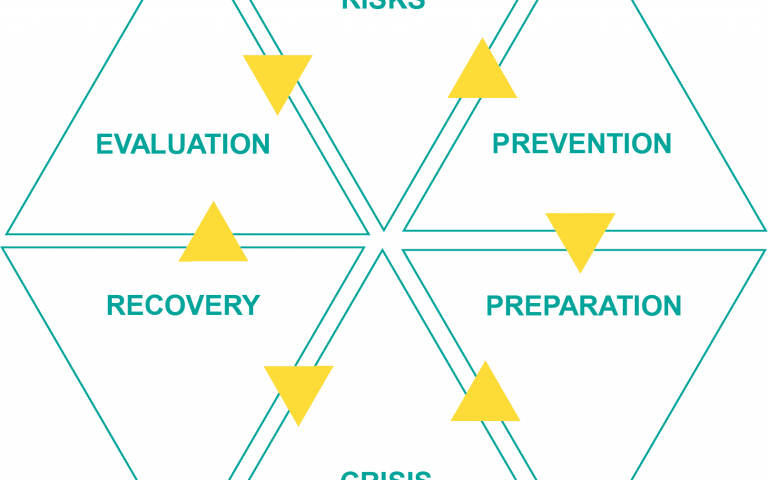

This pandemic created much pain, panic and terror. Many died and lives were twisted inside-out. There have been, and continue to be, hardships. I certainly don’t intend to minimize that in any way. I submit to you, though, that if we also pay careful attention, we can extract some positive, practical and valuable, lessons that we can apply to our businesses. This article talked about three of them: technology’s place in the ever-evolving landscape of business, the lesson of diversification and the need to control cash-flow (which includes taking distributions). These should be cornerstones of every business strategy.

***

TIITAN Business Development Group, LLC

business coaching and advisory services